Invesco: A Boat On The Rising Tide

A long-only portfolio is reliant on economic prosperity to increase in value. The simplest place to look for alpha is in businesses that receive outsized benefits from economic growth, are durable, and trade at cheap multiples. Asset managers clearly fit the mold as rising asset prices increase AUM and revenue.

Industry:

“The strategies across firms in our industry are not very different, what separates winners and losers are those organizations that can execute effectively across all cycles and market conditions.” -Former Invesco CEO Marty Flanagan

Asset managers don’t have obvious “moats” or clear competitive differentiation. While standard asset management services are commoditized, assets are quite sticky, difficult to gather, and revenue is tied to overall market performance net of fee compression. Quality asset managers can remain relevant even as trends change. Consider the two primary trends in standard asset management:

Active → Passive

Mutual Funds → ETFs

Passive funds have gathered $4.8T in net new flows over the past decade, while active funds have shed $1.2T via outflows. ETF AUM has grown from 5.6% of mutual fund AUM in 2006 to 43.2% in 2022:

As a testament to the resilience and stickiness of quality standard funds, T.Rowe Price is on the wrong side of both trends, known primarily for active mutual funds, yet has compounded AUM at similar rates to Invesco and BlackRock.

Competitive Position:

The key differences between the 111 publicly traded asset managers is the mix of underlying assets, the mix of distribution vehicles, and trajectory of AUM.

Asset managers are a small tax on client’s underlying assets, so investors must be confident those assets are of adequate quality. Alternative managers like Blackstone are heavily dependent on the managers. Managers are less important with standard assets: Invesco’s total AUM mix is 50% equities, 20% fixed income, 15% money market, 10% alternatives, and 5% balanced (mixed funds). This is what would be expected to be seen in a typical American’s retirement account, and should perform just fine.

Invesco’s mix of distribution vehicles is more opaque, perhaps purposefully obfuscated. About 60% of AUM or $870B is easily traceable to ETFs and mutual funds (adding money market). Another ~10% is in “private alternatives”, direct investments in real estate, private equity, private credit, MLPs, and bank loans. Another 5% can be traced to collective trust funds, variable insurance funds, SMAs, and closed-end funds. The other 25% is unclear, but includes individual savings accounts, institutional separate accounts, and unit investment trusts.

Invesco has seen outflows this year, like many firms in the industry. A lackluster 2022 for fund flows has largely continued throughout the first half of 2023:

Invesco has seen net outflows of ~$5B in the first half of 2023, but has reported positive inflows from ETFs and fixed income (as rates rise) in Q1 and Q2. And while the market has been receptive to negative commentary surrounding Invesco, $5B of outflows on a $1.5T asset base does very little to cause durability concerns.

At a $10B annualized outflow, it would take 150 years with zero appreciation in asset prices for Invesco AUM to zero. This is a significant margin of safety, considering fund flows are cyclically depressed.

Invesco is well positioned as the 4th largest ETF issuer. Invesco’s flagship fund is the Nasdaq 100 ETF, QQQ. QQQ was developed as a marketing tool by Nasdaq, and ownership was transferred to PowerShares, which was acquired by Invesco in 2006. Invesco generates no profit from QQQ, fees are split between the trustee (The Bank of New York Mellon) and Nasdaq. It’s still beneficial as remaining revenue must be spent on marketing, which builds Invesco’s brand and helps cross sell other funds.

While ETFs are just 30% of Invesco’s AUM, and Invesco certainly has its share of convoluted B2B relationships, its market share in retail investment management makes it easier to understand than some of its peers such as Alliance Bernstein, Ameriprise Financial, Principal Financial Group, Northern Trust and SEI. SEI is the only of this group compounding AUM at a similar rate to Invesco.

Valuation & Capital Allocation:

Invesco trades at 10.5x TTM FCF, ex SBC and preferred dividends. Invesco’s 5.5% dividend yield is higher than the 10-year treasury. The market is underestimating the challenge of building a book of $1.5T AUM. Invesco trades at a significant discount to BlackRock, the shining star of asset management, but Invesco has held its own:

Capital allocation has been an issue, namely the perpetual $59M quarterly drag on earnings and 81.9M shares issued for the $5.8B acquisition of OppenheimerFunds. Making a large active manager purchase was an unforced error even at that time:

At a time when many investors are deserting active funds for products that track indexes, Invesco chief executive officer Martin Flanagan is convinced that active funds will continue to play a critical role in the portfolios of retail and institutional customers. “Investors are looking for a broad range of ways to have us meet their outcomes—it is high-conviction active management, it is passive and it is alternatives."

Active funds have continued to struggle, and while the acquisition appears to have been value destructive, the acquired funds aren’t worthless, and it has been priced in.

Some financial sites erroneously list Invesco with over $10B of net debt, in actuality the company has about $1.5B of total debt. The preferred shares related to the OppenheimerFunds acquisition are valued at $4B, and the remaining debt is related to CIPs, consolidated investment products, which have no impact on Invesco’s financials:

“The majority of the company's CIP balances are CLO-related. The collateral assets of the CLOs are held solely to satisfy the obligations of the CLOs. The company has no right to the benefits from, nor does it bear the risks associated with, the collateral assets held by the CLOs, beyond the company's direct investments in, and management and performance fees generated from, the CLOs.”

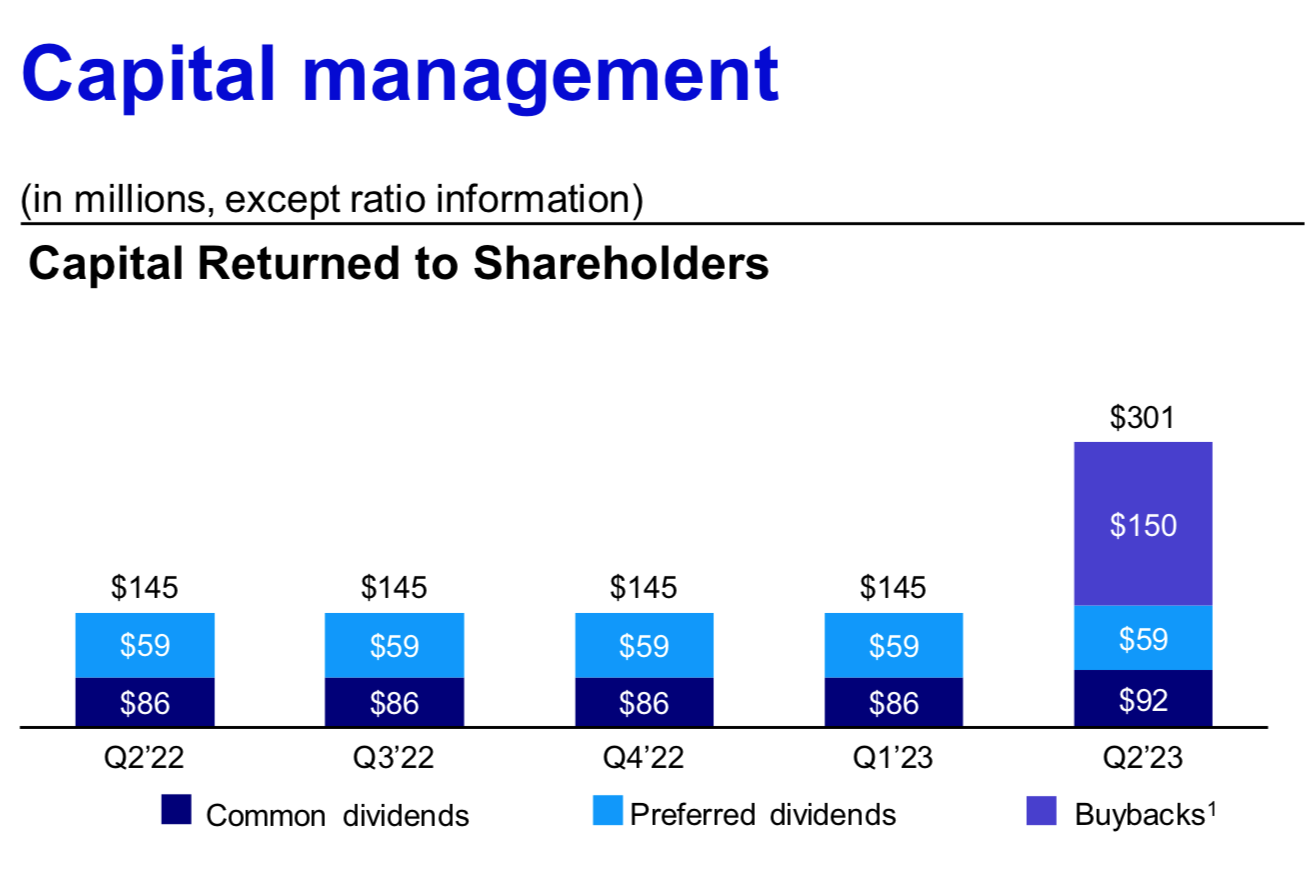

Along with Invesco’s 5.5% dividend, the business has been began repurchasing shares:

The current actions management is taking appear to be shareholder friendly. Invesco’s leverage ratio adding back the theoretical value of the preferred shares is around 3x, so it’s unlikely there’s room for significantly poor decisions to be made.

Invesco is a solid asset backed by solid assets, and the shares are cheap. Simple investment theses aren’t exciting or popular, but they can be effective.